Email: [email protected]

We’ve Helped Over 600

Clients & Removed $30 Million

in Debt—Are You Next?

This isn’t a quick fix.

It’s a six month full program designed to clean your credit, rebuild it correctly, and set you up for funding — with guidance every step of the way.

When you sign up with BluPrint Credit, you’re not guessing or jumping straight to funding.

We follow a proven, step-by-step process designed to clean, rebuild, and position your credit profile correctly.

We start by reviewing and cleaning your credit profile, identifying inaccurate, unverifiable, or outdated information and addressing it using the proper laws and strategy. From there, we guide you through rebuilding the right way — adding the correct accounts, improving utilization, and strengthening your overall profile without causing harm.

As you move through the process, you’ll gain access to our community, education, and live breakdowns, so you understand what’s happening and why. Once your profile is properly positioned, we help you prepare for personal and business funding, focusing on timing, structure, and lender expectations — not shortcuts.

WHO IS bLUPRINT MEMBERSHIP FOR?

NO-CREDIT

Just getting started with no credit history?

Learn how to build credit from scratch, understand how credit really works, and create a strong foundation the right way — from day one

FAIR -CREDIT

Working full-time but ready to level up?

Learn how to fix and leverage your credit, qualify for funding, and build wealth without quitting your 9–5. Do all this without breaking the

bank!

BAD-CREDIT

Already in business or planning to start?

Gain credit and funding strategies used by real entrepreneurs who’ve secured approvals, scaled companies, and built fundable profiles.

BUSINESS OWNERS

Ready to scale the right way?

Optimize personal & business credit, unlock higher funding limits, and position your business for growth, expansion,.

GET YOUR FREE

ASSESSMENT NOW!

Join hundreds of clients who started with clarity — not confusion.

This free assessment gives you a clear snapshot of your credit — no pressure, no obligation. We’ll identify inaccuracies, negative factors, and missed opportunities, then outline the next best steps based on your goals. Whether you’re rebuilding or preparing for funding, this is where smart credit decisions start.

What you will get access to

Dispute & Cleanup Guidance

Learn how credit disputes actually work, what can be challenged, and how to clean your profile the right way without damaging progress.

Credit Education (Done Right)

We break down credit laws, scoring factors, and reporting rules so you understand what’s happening — not just wait for results.

Funding Readiness Preparation

Learn what lenders look for and how to prepare your credit for approvals — personal and business — without rushing the process.

BluPrint Community Access

Join a community of people actively fixing their credit, asking real questions, and getting live breakdowns and support.

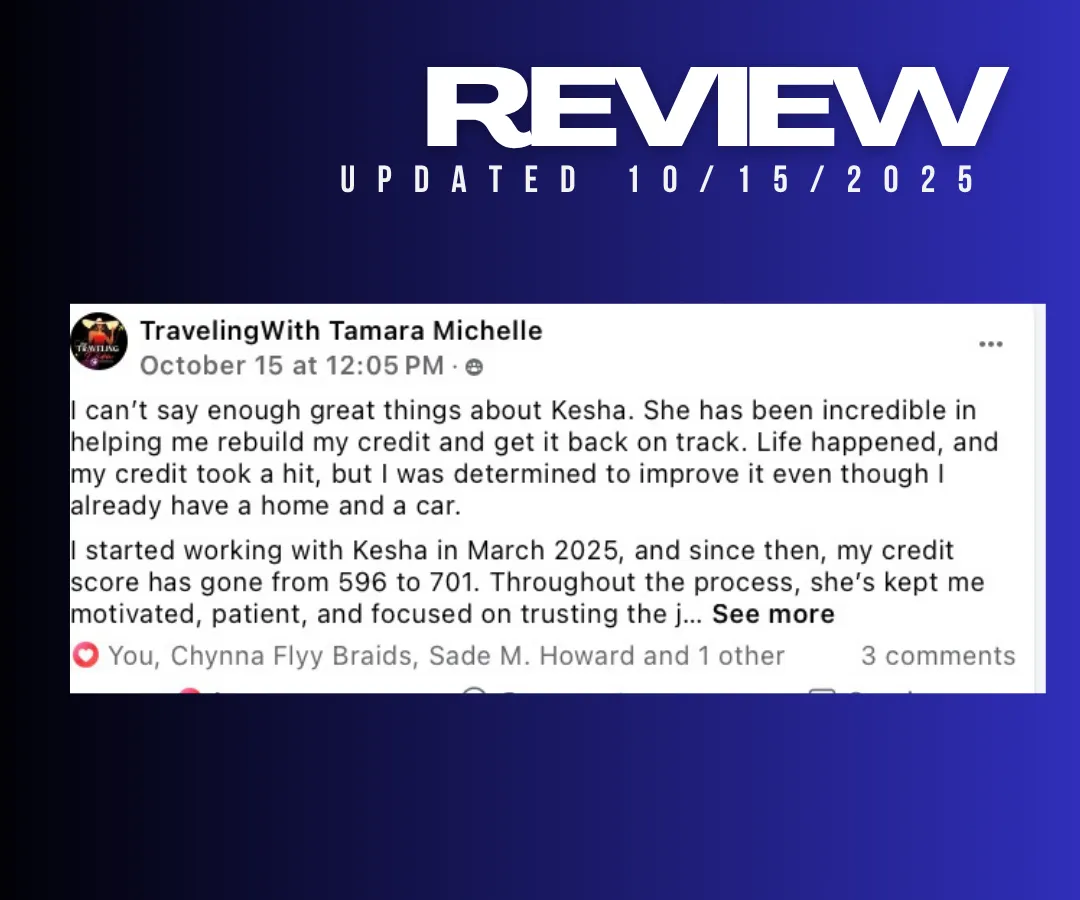

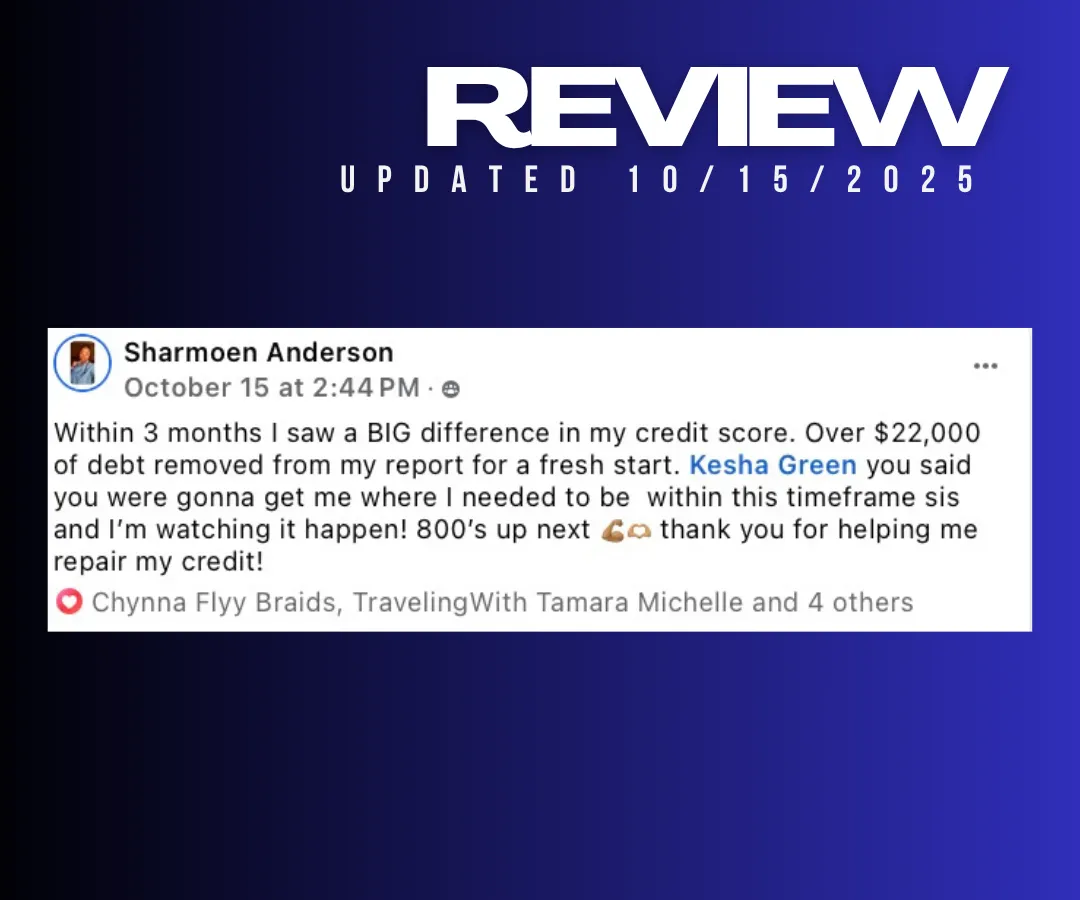

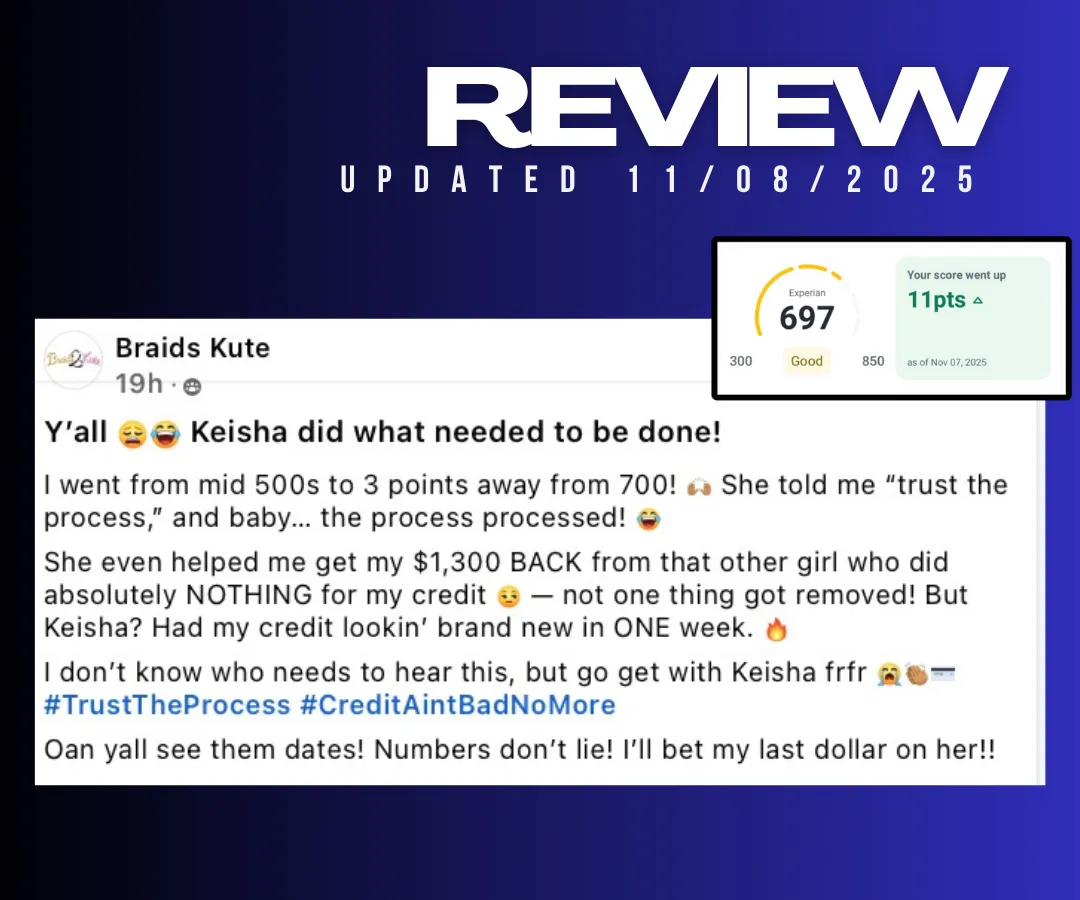

TESTIMONIAL

THESE ARE SOME OF OUR

CLIENTS RESULTS

Frequently Asked Questions

Get your questions answered

How quickly can I expect to see results?

Results vary for each client, but many begin seeing movement within the first 30–45 days, depending on the accuracy of their credit report, the number of items being addressed, and how quickly creditors and bureaus respond. Credit repair is a process, not an overnight fix, and consistency is key.

What happens if I don’t see results right away?

Credit repair works in rounds. Some items are resolved quickly, while others may take additional time and follow-ups. If something doesn’t move right away, we reassess the strategy and continue working until the account is properly resolved or exhausted under the law.

What happens if I don’t see results right away?

Credit repair works in rounds. Some items are resolved quickly, while others may take additional time and follow-ups. If something doesn’t move right away, we reassess the strategy and continue working until the account is properly resolved or exhausted under the law.

Do I need good credit to get started?

No. BluPrint Credit works with clients at all stages — whether you’re rebuilding from scratch, dealing with collections or charge-offs, or preparing for future funding. Your starting point does not disqualify you.

Do you only remove negative items, or do you help rebuild too?

We do both. Removing negative or inaccurate items is only part of the process. We also help you rebuild correctly, improve utilization, strengthen payment history, and understand how to maintain your results long-term.

JOIN THE SUCCESS JOURNEY

Stay Connected, Stay Ahead.

Join our network for valuable insights, updates, and resources to

fuel your growth.

Join Our Community

Connect with a network of growth-driven individuals and gain valuable insights.

MONEY-BACK GUARANTEE

Our 100% Risk-Free

Promise to You

If you don’t see improvements in your credit after completing the first 90 days, we’ll refund your investment—no questions asked. Your success is our priority!